NOT FOR DISSEMINATION, DISTRIBUTION, RELEASE, OR PUBLICATION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

Vancouver, British Columbia, May 17, 2021 – IM Exploration Inc. (CSE: IM) (“IM” or the “Company”) is pleased to announce that it has entered into a binding Letter of Intent (the “LOI”) with Momentum Minerals Ltd. (“Momentum”), a private company headquartered in Vancouver, British Columbia, to acquire all of the issued and outstanding shares of Momentum (the “Momentum Shares”) by way of a three-cornered amalgamation (the “Transaction”).

Momentum is currently earning in to a 100% ownership position in the Turquoise Canyon Property (“Turquoise Canyon”), which lies to the immediate east of IM’s Toiyabe Gold Project (“Toiyabe”). Details of Momentum’s option agreement are further described below.

Transaction Details

The Transaction will be completed by way of a three-cornered amalgamation under the Business Corporation Act (British Columbia) (the “BCBCA”) among IM, Momentum and a subsidiary to be incorporated under the BCBCA which will be wholly-owned by IM (“IM Subco”). Pursuant to the Transaction, Momentum will amalgamate with IM Subco and the holders of Momentum Shares will receive 0.6 of a common share of IM (each whole common share of IM, an “IM Share”) for every one Momentum Share. It is expected that approximately 19,817,400 IM Shares will be issued to the current shareholders of Momentum as consideration for all of the outstanding Momentum Shares pursuant to the amalgamation. The amalgamated company will become a wholly-owned subsidiary of IM. IM will also issue 240,000 replacement options to current Momentum option holders, allowing such holders to purchase IM Shares at a price of $0.167 until April 14, 2026. There are currently 33,029,001 Momentum Shares and 400,000 options of Momentum outstanding. Upon closing of the Transaction, IM may also issue up to 10% of the number of IM Shares issued to Momentum shareholders as a finder’s fee (the “Finder’s Fee Shares”).

Johnathan Dewdney, a director of the Company, owns and controls 400,000 Momentum Shares and has abstained from voting in respect of the Transaction. Upon closing of the Transaction, the capitalization of IM will consist of 46,035,733 IM Shares, 2,190,000 options and 5,198,333 purchase warrants to acquire IM Shares, excluding any Finder’s Fee Shares issued.

Current Momentum shareholders will own approximately 43.0% of the combined company on a nondiluted basis, and 37.1% on a fully-diluted basis, before giving effect to any Finder’s Fee Shares.

Momentum currently has approximately C$1.5 million in cash and no debt. IM Shares issued in exchange for Momentum Shares previously issued in its founders’ round at prices less than $0.05 will be subject to a 24-month hold period, with 25% of the IM Shares being released every 6 months, with the first release occurring 6 months after the closing of the Transaction. IM Shares issued in exchange for Momentum Shares previously issued in its $0.05 seed round will be subject to a 12-month hold period, with 25% of the IM Shares being released every 3 months, with the first release occurring 3 months after the closing of the Transaction.

All of the existing Board of Directors and management of IM will remain following the completion of the Transaction. Upon closing, Colin Moore, a current Director of Momentum, will be appointed President of IM.

Raymond Harari, CEO of IM, commented: “We are extremely pleased that we’ve come to an agreement to add another highly-prospective property to IM, in one of the top mining jurisdictions in the world. We welcome all current Momentum shareholders and are excited to continue unlocking value through the combined company.”

Colin Moore, Director of Momentum, added: “Having both these properties under one corporate banner will allow us to take a methodical and holistic approach to exploration, and the combined land package provides an exciting base from which to grow.”

Completion of the Transaction is subject to a number of conditions, including the following:

satisfactory due diligence by each party of the other party;

the parties entering into a definitive amalgamation agreement within 180 days of the date of the LOI;

no material adverse change shall have occurred in the business, results of operations, assets, liabilities, financial condition or affairs of either party, financial or otherwise, between the date of the LOI and the completion of the Transaction;

receipt by each party of all shareholder approvals necessary or desirable in connection with the Transaction;

receipt of all necessary regulatory and third party consents, approvals and authorizations as may be required in respect of the Transaction, all such consents, acceptances and approvals to be on terms and conditions acceptable to the parties; and

IM shall not be in default of the requirements of the Canadian Securities Exchange or any securities commission and no order shall have been issued and currently in effect preventing the Transaction or the trading of any securities of IM.

About Momentum Minerals

Momentum is a private mining exploration company incorporated in British Columbia and headquartered in Vancouver. Momentum currently has the right to earn in to a 100% ownership position in Turquoise Canyon, through its option agreement with First Mining Gold Corp. (“First Mining”). Further details of the earn-in are laid out below. In order to acquire a 100% ownership position in Turquoise Canyon, Momentum must pay First Mining up to C$500,000, as follows:

-

C$25,000 in cash within 30 days of closing, which Momentum has paid;

-

1,000,000 Momentum Shares, which Momentum had issued to First Mining at C$0.10 per Momentum Share. The value of such Momentum Shares shall be counted towards the payments owing to First Mining on August 21, 2021 (see below);

-

C$50,000 in cash or Momentum Shares to be paid by August 21, 2020. Momentum has paid the fee in Momentum Shares;

-

C$150,000 in cash or Momentum Shares to be paid by August 21, 2021 and Momentum has paid $100,000 in Momentum Shares to date;

-

C$137,500 in cash or Momentum Shares to be paid by August 21, 2022; and

-

C$137,500 in cash or Momentum Shares to be paid by August 21, 2023.

In addition to the payments listed above, Momentum will be required to incur exploration expenditures on the property totalling C$750,000 over the 4-year option period, and must incur at least C$50,000 in year 1 and C$100,000 in year 2. To date, approximately C$163,000 has been spent at the property, and a C$183,000 exploration program has been planned for the summer of 2021.

First Mining will retain a 2% Net Smelter Royalty on the property, half of which (1%) can be bought back for C$1,000,000 up until the 1st anniversary of commercial production.

About Turquoise Canyon

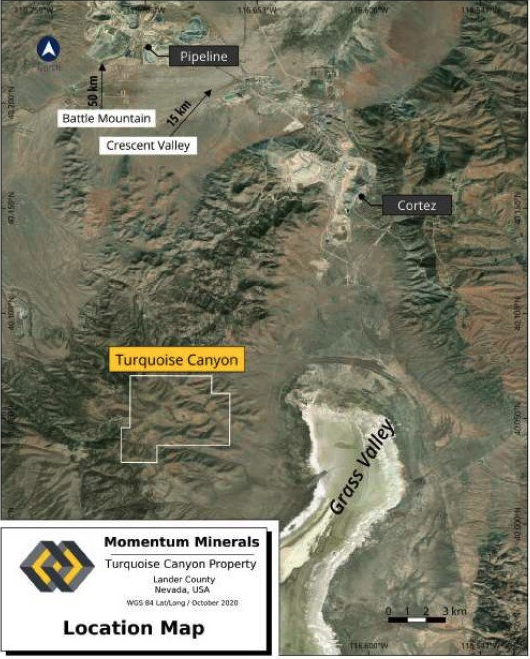

The Turquoise Canyon Property is compromised of 188 unpatented lode claims in Lander County, Nevada and lies within the Battle Mountain – Eureka Trend, a 280 by 40-kilometer corridor known for hosting multiple large Carlin-type gold deposits. The property is located approximately 20 kilometers south of Barrick’s North Pipeline Mine and 14 kilometers south-west of the Cortez Mine. Turquoise Canyon lies to the immediate east of, and contiguous to, IM’s Toiyabe Project.

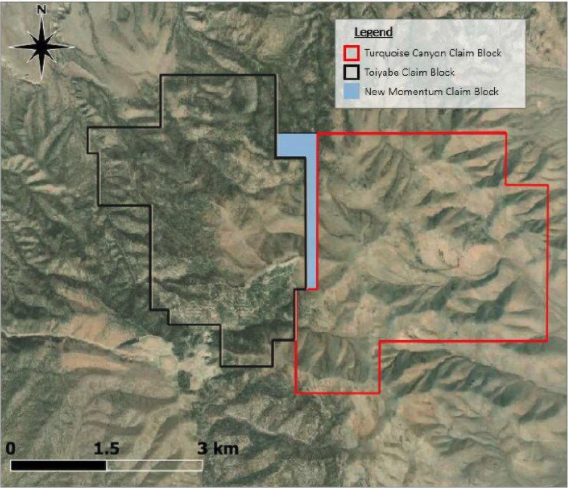

Turquoise Canyon currently encompasses approximately 3,872 acres. In addition to the existing property area under option with First Mining, Momentum has staked an additional 9 claims totalling approximately 186 acres by the northern end of the property where an unclaimed gap existed between Toiyabe and Turquoise Canyon. Those claims are 100% owned by Momentum with no underlying future commitments.

The consolidated land package upon closing of the Transaction will cover an area of approximately 7,358 acres, including 3,300 acres of the Toiyabe Project.

Figure 2: Consolidated Claim Block Outlines

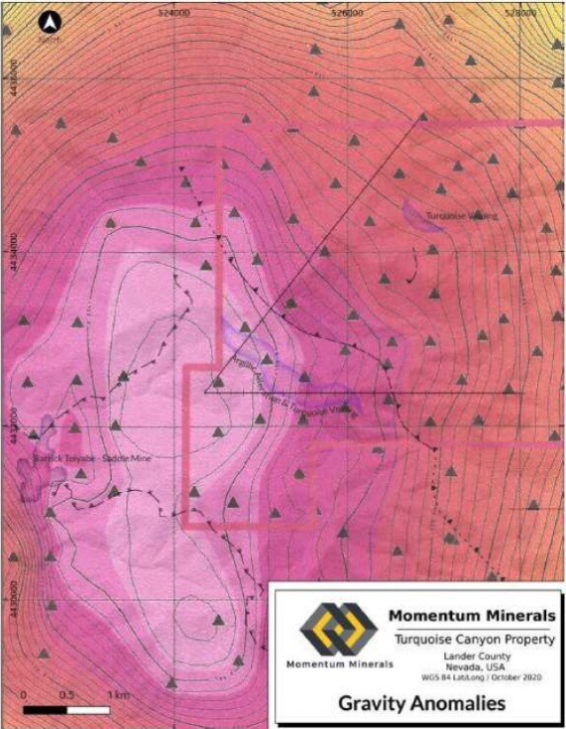

A 43-101 Technical Report was prepared for Turquoise Canyon in February of 2021 by Ethos Geological. Exploration to date includes two IP lines, a gridded gravity survey, rock and channel sampling, geological mapping, and drone-based aerial mapping. IP lines resolved the boundary of the conductive Lower Plate underlying the Upper Plate, and sampling and mapping confirmed metal enrichment along prominent structures.

Upper Plate siliciclastics and Lower Plate carbonates form the regional geology. The Lower Plate hosts the majority of gold production in the Battle Mountain – Eureka Trend, in structurally and stratigraphically controlled replacement bodies of disseminated gold mineralization referred to as Carlin-Type Gold Deposits. The assemblage of carbonate rocks to the west and southwest of the property have been mined in the past (Toiyabe-Saddle Mine) and drill tested (IM’s Toiyabe Project), and dips to the east / northeast towards Turquoise Canyon. At Turquoise Canyon, the Upper Plate has been stacked over the prospective Lower Plate carbonates along the Roberts Mountain Thrust. Mineralization within the Upper Plate is exposed in outcrops, trenches, pits and cuts long a 2.5-kilometer altered zone with turquoise veining, indicating the potential for buried mineralizing systems within the Lower Plate at depth (Ethos Geological, 2021).

The Technical Report recommended that future exploration work at Turquoise Canyon consist of drilltesting the roots of the altered zones for feeder conduits that may have brought mineralization up along steep structures from the underlying carbonates. Prior to confirming anticipated drill targets, Momentum has planned an exploration program for the summer of 2021 that will consist of 13.5 line-kilometers of Induced Polarization (IP) through Toronto-based consulting firm Simcoe Geoscience, which will enhance the suite of available geological information at the property. Simcoe will also be analyzing all legacy data for reprocessing, modeling, and interpretation.

The technical information contained in this news release was reviewed and approved by Chris Osterman who is a Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About IM Exploration

The Company is a mineral exploration company, currently exploring for graphite, gold, and other minerals at its early-stage Mulloy Project in Northern Ontario and the Toiyabe Gold Project in Lander County, Nevada. From time to time, the Company may also evaluate the acquisition of other mineral exploration assets and opportunities.

For further information contact:

Raymond D. Harari

President and Chief Executive Officer

IM Exploration Inc.

rdh@canaliscapital.com

Tel: +507-6675-2221

The securities to be issued pursuant to the Transaction have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release. The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this news release.

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, including, but not limited to, the completion of the Transaction and related matters. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of IM Exploration Inc., including, but not limited to, the impact of general economic conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, dependency upon regulatory approvals, the uncertainty of obtaining additional financing and exploration risk. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.